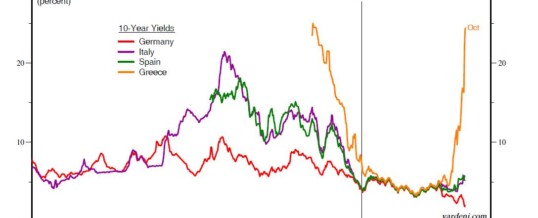

The 30-year Treasury bond was down 1-7/32, its yield rising to 3.06 percent from 3.01 percent late on Thursday.

Major stock market indexes were each up more than one percent. (Reporting by Ellen Freilich; Editing by Chizu Nomiyama)

First Published: 2011-12-09 17:18:10

Updated 2011-12-09 18:13:54

DEC