Republished from Dr. Ed Yardeni’s blog: “Dr. Ed’s Blog”

Has there ever been a margin call on the debt of the government of a major industrial economy before? I don’t think so, but there was one yesterday on the Italian government’s debt. On Wednesday, clearing house LCH.Clearnet SA raised initial margin requirements on Italian bonds across a range of maturities. The margin on bonds due between 7-10 years was raised by 5 percentage points to 11.65%, for bonds due between 10-15 years it was raised by 5 percentage points to 11.80%, and for bonds that mature in 15-30 years the margin was raised by 5 percentage points to 20%.

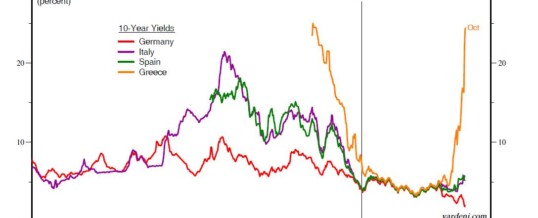

The yield on the benchmark 10-year Italian government bond soared above 7%, the level that prompted Greece, Ireland, and Portugal to seek bailouts from the EU. Just as alarming, shorter-dated yields rose at an even faster clip, with the two-year yield climbing nearly a full percentage point to 7.11%. The yield on Treasury bills due in a year’s time breached 6%. That’s not a good sign ahead of Italy’s €5 billion auction today.

The selloff occurred despite news that Italian Prime Minister Silvio Berlusconi may step down. Under Berlusconi, Italy’s public debt soared above a record $2.6 trillion, or about 120% of GDP, the second largest imbalance in Europe after Greece. This happened as the government financed Italy’s bloated social welfare state with more and more government bonds. Bond investors weren’t very vigilant and willingly purchased these bonds at slight premiums to German bonds, especially after the formation of the euro zone. Obviously, my old friends the Bond Vigilantes have been stirred and are now attacking Italy just as the barbarians invaded the Roman Empire many centuries ago.

What incited them to riot now? Ironically, it was the third Grand Plan (GP-3.0) fashioned by European leaders on October 27 to rescue Greece and shore up confidence in the euro by bolstering the EFSF rescue fund. GP-1.0 was the first rescue plan for Greece, which was implemented during May 2010. GP-2.0 was the second plan approved by EU leaders on July 21, which included a voluntary 20% haircut on Greek debt. GP-3.0 will go down in history as a case study in unintended consequences:

(1) Cancelling insurance policies was a mistake. GP-3.0 destroyed the CDS market for European sovereign debt by forcing lenders to accept “voluntary” 50% haircuts on their Greek debt. That led to more selling of Italian bonds by investors, who had bought credit default swaps to reduce their downside risks.

(2) A plan without details is an outline, not a plan. By failing to detail just exactly how the EFSF would be levered up from €440 billion (as set by GP-2.0) to over €1.0 trillion, GP-3.0 depressed the demand for EFSF bonds, as evidenced by the bad reception for the €3 billion auction of the rescue fund’s bonds on Monday.

(3) Raising and dashing expectations doesn’t instill confidence. Raising expectations that China might help to fund the EFSF was also a big mistake, especially since these hopes were so quickly dashed after the Chinese rebuffed the European fund raisers recently.

NOV

About the Author: